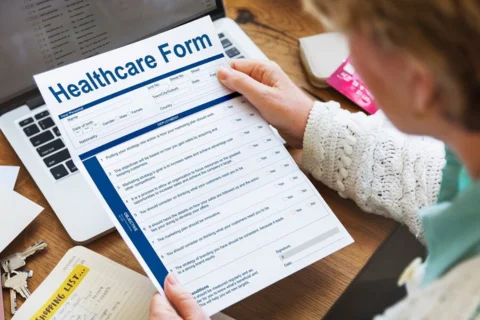

Essential Health Insurance Tips: Find the Best Coverage for You

Choosing the right insurance health insurance innovations stock plan can be daunting, but understanding some essential tips can make the process easier and more effective. Here’s how you can find the best coverage for you and your family:

Understand innovative insurance partners for health Benefits

One of the fundamental aspects of innovative partners health insurance is knowing what benefits are covered. Under the Affordable Care Act, all health plans innovative partners health insurance cancellation reddit must cover essential health benefits. These include preventive care, emergency services, prescription drugs, and mental health and substance abuse services. Make sure your plan covers these core benefits to avoid unexpected out-of-pocket costs and also a innovative partners health insurance phone number.

Evaluate Coverage for Habilitative and Rehabilitative apwu health Plan

When national general insurance reviewing, insurance for health plans or apwu insurance of health reviews, and health and bunnies insurance marketplace checking if they cover habilitative and rehabilitative services is crucial. Habilitative services help individuals develop or maintain skills and functions, while rehabilitative services assist in recovery after an illness or injury. Verify these services are included to ensure comprehensive care.

Compare Plans For Preventive Care With Freedom Health Insurance

Preventive upkeep is essential for supporting long-term health Freedom Life Health Insurance and evading more severe conditions. Most health plans offer preventive services, such as vaccinations and screenings, without additional costs. Review your plan’s preventive care coverage to take advantage of these crucial services with freedom health care insurance.

Check for Dollar Limits and Coverage Requirements With health insurance giant

Insurance plans have dollar limits on certain services or benefits of insurance giant crossword. Knowing these limits and any required coverage is vital to prevent unexpected expenses with marketplace of insurance giant food employee for health. Ensure the plan you choose covers essential health benefits without imposing restrictive limits.

Understand What's Included In Your Justin Brain Insurance for good Health

Each health plan can vary in terms of what it covers and how it manages costs. Review details about covered services, including emergency services, prescription drug coverage, and mental health support and also stride health of insurance. Knowing what’s included can help you avoid surprises and get the care you need.

Review Benchmark Plans for Quality

Benchmark plans of health for insurance companies are used to compare insurance options. They are designed to provide a baseline of coverage, making comparing different plans’ benefits and costs easier. Evaluate benchmark plans to understand the quality and extent of coverage available with Sutter insurance for business or health as well as life insurance .

Consider Individual and Small Group Plans with gap

Gap insurance for health vary for individuals and small groups. Unique plans are tailored to a single person, while short group plans are developed for businesses and their workers. Consider your situation to choose the plan that best fits your needs and gap coverage.

Know The Federal Government's Role For Health Insurance Attorney

The federal government regulates plans and ensures they meet specific standards. Please familiarize yourself with the Affordable Care Act and other federal regulations to understand how they affect your health coverage options.

With these essential health tips, you can make an informed decision about your health dream. Evaluate each plan carefully, considering the benefits, coverage, and costs to find the best option for you and your family.

Why Choosing Us For Essential Insurance

- Advantages of Insurance Plans Discover the numerous benefits of having insurance, from protecting against unexpected medical expenses to ensuring you have access to quality healthcare. This post highlights the key advantages of securing a health plan for peace of mind and financial security.

- Best Plans for Family Insurance for Health Choosing the right family insurance plan is crucial for your loved ones’ wellbeing. This guide covers the best options for comprehensive coverage, ensuring your family gets the protection it needs without breaking the bank.

- Top 5 Companies Not all providers are the same. This post reviews the top five companies based on their customer satisfaction, pricing, and coverage options, helping you make an informed choice.

- Best Women’s Health Coverage Planes Women’s health insurance needs are unique, and this post dives into the best health plans tailored specifically for women, covering everything from maternity care to preventive screenings.

- Best Health Options for Women insurence Explore the best plans designed to address the specific needs of women. Whether you’re looking for reproductive health benefits or general wellness coverage, this guide has got you covered.

- Top Rated Cancer Insurance Plans in the USA Cancer insurance is an essential coverage for those seeking additional protection against the costs of cancer treatment. Learn about the top-rated cancer insurance plans in the USA and how they can help mitigate the financial burden of cancer care.

- Everything About Cancer Insurance This post offers a comprehensive overview of cancer insurance, explaining what it covers, how it works, and why it’s an important addition to your portfolio.

- The Best Cancer Insurance Plans If you’re considering cancer insurance, this post highlights the best plans available, focusing on coverage benefits, affordability, and the level of support you can expect from top providers.

- How Should I Choose a Life Insurance Agent Choosing the right life insurance agent is critical to finding the best policy for you. This guide offers practical tips on how to select an agent who understands your needs and can provide valuable advice.

- Pick a Life Insurance Company Selecting the right life insurance company is a big decision. This post walks you through the key factors to consider, ensuring you choose a reliable provider with the right coverage options for your life insurance needs.

- Buying Life Insurance Are you looking to buy life insurance but don’t know where to start? This post covers the steps involved in purchasing life insurance, helping you understand the process and choose the best policy for your future.

- Best Dental Insurance Plans for 2024-25 Ensure your dental health is well-protected with the best dental insurance plans for 2024-25. This guide reviews the top plans based on coverage, cost, and overall value.

- Best Dental Insurance Plans for Individuals Finding dental insurance that fits your needs as an individual can be challenging. This post highlights the best dental plans for individuals, covering everything from preventive care to major procedures.

- Info Required to Confirm Dental Insurance Before you confirm your dental insurance, make sure you have all the necessary information. This post provides details on what you need to know and gather before finalizing your dental coverage.

- Compass Best Student Plans As a student, is essential for covering medical costs during your academic journey. This post reviews the best student plans offered by Compass, ensuring you get the protection you need.

- Best Student Plans Looking for the best plan as a student? This guide provides an in-depth comparison of the top student options available, including coverage, affordability, and benefits.

- Affordable Compass for Students Affordable is crucial for students, and Compass offers great options. Learn about the best Compass Life plans for students that are both budget-friendly and comprehensive.

Recent Post

Our Health Insurance Guidance Blog

Popular Blog

-

How should I choose a life insurance agent?

How should I choose a life insurance agent? -

Essential Health Insurance Tips: Find the Best Coverage for You

Essential Health Insurance Tips: Find the Best Coverage for You -

Top-Rated Cancer Insurance Plans in the USA | Your Guide to the Best Coverage Options

Top-Rated Cancer Insurance Plans in the USA | Your Guide to the Best Coverage Options -

Business Insurance for Fiber Optic Cable in the USA

Business Insurance for Fiber Optic Cable in the USA -

Affordable Healthcare for Students | A Review of Compass Health Insurance

Affordable Healthcare for Students | A Review of Compass Health Insurance -

How do I pick a life insurance company?

How do I pick a life insurance company? -

Everything You Need to Know About Cancer Insurance

Everything You Need to Know About Cancer Insurance -

Advantages of Leading Health Insurance Plans USA

Advantages of Leading Health Insurance Plans USA -

Top 5 Health Insurance Companies in the USA

Top 5 Health Insurance Companies in the USA -

Explore the Best Dental Insurance Plans for 2024-25

Explore the Best Dental Insurance Plans for 2024-25